42 yield to maturity of a coupon bond formula

Yield to Maturity Calculator | Good Calculators The calculator uses the following formula to calculate the yield to maturity: P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y Where: P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Bond Yield to Maturity (YTM) Calculator - DQYDJ The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in the calculator: Current Price: $920 Par Value: $1000 Years to Maturity: 10 Annual Coupon Rate: 10%

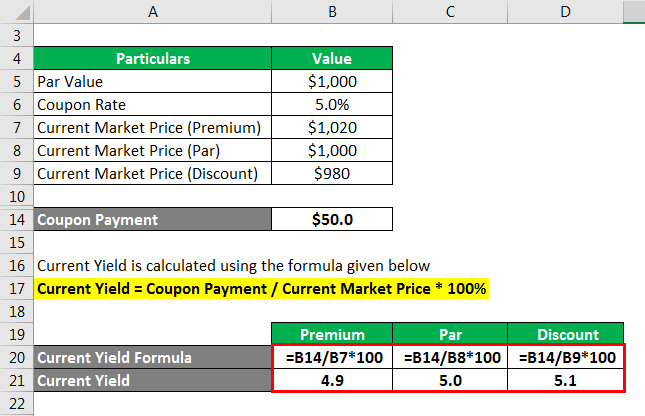

Bond Yield Formula | Step by Step Calculation & Examples Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity. Step 1: Calculation of the coupon payment Annual Payment. =$1000*5%.

Yield to maturity of a coupon bond formula

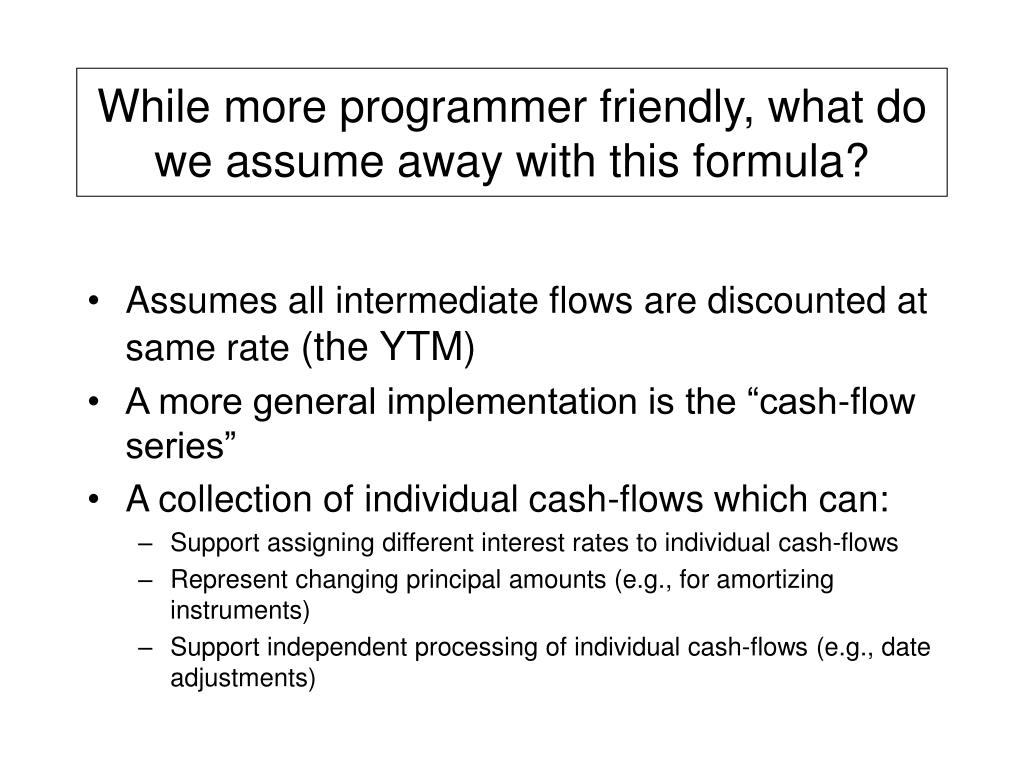

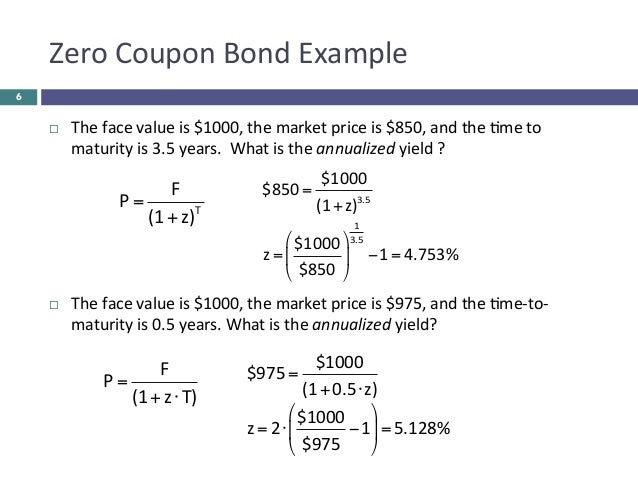

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% ...

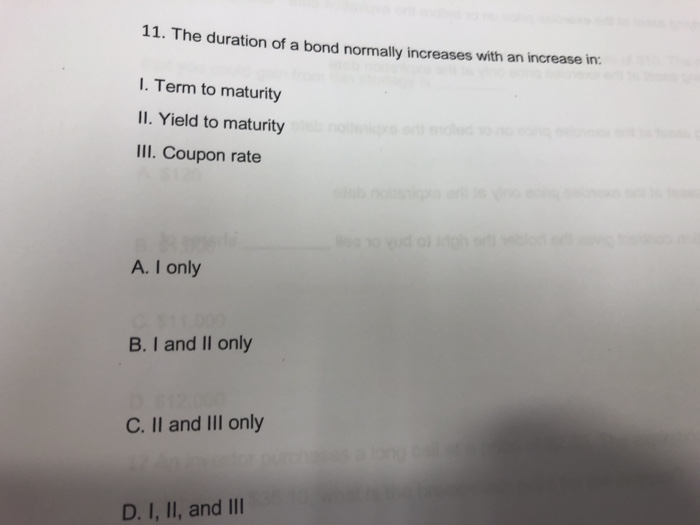

Yield to maturity of a coupon bond formula. How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. ... Plug the yield to maturity back into the formula to solve for P, the price. Chances are, you will not arrive at the same value. ... where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M ... Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Bond Yield Formula | Step by Step Calculation & Examples Bond Yield Formula = Annual Coupon Payment / Bond Price. Bond Prices and Bond Yield have an inverse relationship; When bond price increases, bond yield decreases. ... frequency of payment, and amount value at the time of maturity. Step 1: Calculation of the coupon payment annual payment. Annual Coupon Payment = Face Value * Coupon Rate =$1300*6 ... Convexity of a Bond | Formula | Duration | Calculation As can be seen from the formula, Convexity is a function of the bond price, YTM (Yield to maturity), Time to maturity, and the sum of the cash flows. The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex ...

Coupon Bond Formula | Examples with Excel Template Therefore, the current market price of each coupon bond is $932, which means it is currently traded at discount (current market price lower than par value). Coupon Bond Formula - Example #2. Let us take the same example mentioned above. In this case, the coupon rate is 5% but to be paid semi-annually, while the yield to maturity is currently ... Yield to Maturity (YTM) - Overview, Formula, and Importance How YTM is Calculated YTM is typically expressed as an annual percentage rate (APR). It is determined through the use of the following formula: Where: C - Interest/coupon payment FV - Face value of the security PV - Present value/price of the security t - How many years it takes the security to reach maturity Answered: (Yield-To-Maturity) for $990. You have… | bartleby Explain your answer. (Hint: The answer is an exact percentage, virtually no calculation needed.) (Yield-To-Maturity) for $990. You have just bought a 5% coupon $1,000 face-value bond with 3 years until maturity (a) Construct the timeline that represents the discounted cash flow. Write down the equation that would calculate the yield-to-maturity ... Yield to Maturity | Formula, Examples, Conclusion, Calculator Mar 24, 2021 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Yield to Maturity Formula & Examples | How to Calculate YTM - Video ... Calculating yield to maturity to find important values is vital for investors in understanding their overall portfolio value. Here is an example of how to find the yield to maturity of a bond whose... Yield to Maturity (YTM): Formula and Excel Calculator Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value. If the YTM > Coupon Rate and Current Yield → The bond is being sold at a "discount" to its par value. If the YTM = Coupon Rate and Current Yield → The bond is said to be "trading at par". Bond Yield Formula | Calculator (Example with Excel Template) The formula for Bond Yield can be calculated by using the following steps: Step 1: Firstly, determine the bond's par value be received at maturity and then determine coupon payments to be received periodically. Both par value and periodic coupon payments constitute the potential future cash flows. Step 2: Next, determine the investment ...

Yield to Maturity - Approximate Formula (with Calculator) Example of Yield to Maturity Formula The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be

Yield to Maturity (YTM) - Definition, Formula, Calculations Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates etc, Please provide us with an attribution link The formula below calculates the bond's present value.

Yield to Maturity (YTM) - Meaning, Formula & Calculation Yield To Maturity Formula Below is the YTM formula Where, bond price = the current price of the bond. Coupon = Multiple interests received during the investment horizon. These are reinvested back at a constant rate. Face value = The price of the bond set by the issuer.

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

How to calculate yield to maturity in Excel (Free Excel Template) Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%.

Bond Formula | How to Calculate a Bond | Examples with Excel Template Bond Formula - Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Bond Yield Definition - Investopedia Jan 01, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Yield to Maturity (YTM) Approximation Formula - Finance Train P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity. Let's take an example to understand how to use the formula. Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9 ...

Current Yield of Bond Formula - EDUCBA The formula for the current yield of a bond can be derived by using the following steps: Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment. Step 2: Next, determine the current market price of the bond based on its own coupon rate vis-à-vis the ongoing yield ...

Yield to Maturity (YTM) - Overview, Formula, and Importance May 07, 2022 · The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity. The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different ...

Answered: (Yield to maturity) A bond's market… | bartleby Formula is =RATE (NPER,PMT,-PV,FV) Q: present value. A: Present value refers to the value of some amount present today that is more valuable than the…. Q: A bond with 20 years to maturity and a face value of $1000 pays semi-annual coupons at a rate of 9%…. A: Given Information:Par value of bond = $1000 Annual coupon rate of bond = 9% (paid ...

Yield to Maturity (YTM) Definition - Investopedia Nov 11, 2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Bond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in ...

Post a Comment for "42 yield to maturity of a coupon bond formula"