43 coupon rate on bonds

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

What is a Coupon Rate? - Definition | Meaning | Example The rate pays 8% annually. The coupon's current yield is 5.22%, and the yield to maturity is 3.85%. What is the coupon payment Georgia will receive? The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

Coupon rate on bonds

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, US Treasury Bonds - Fidelity US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly based on discount rates for 13-week treasury bills, principal at maturity: Treasury STRIPS: $1,000: Discount: ... Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. ... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

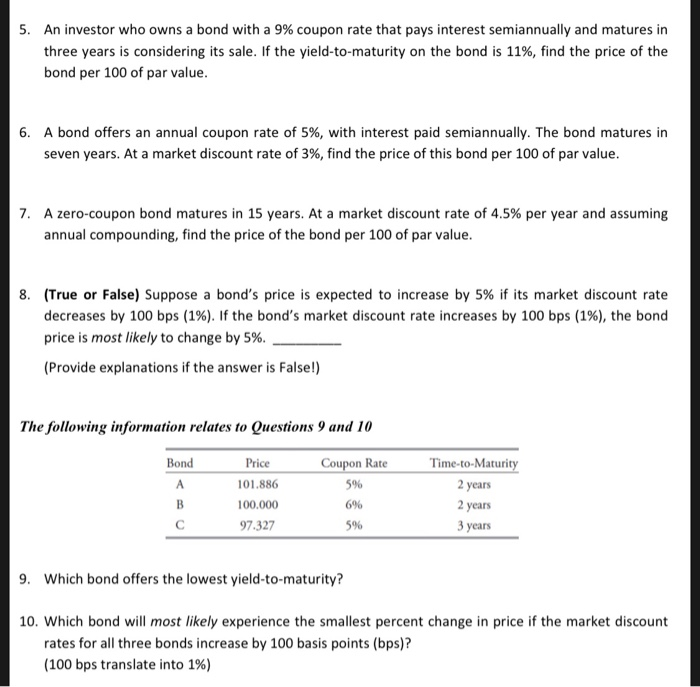

Coupon rate on bonds. Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond ... Floating Rate Bonds: Characteristics, Rate, and Important Floating Rate Bonds offer certain benefits to both investors and issuers against the traditional fixed-rate bonds. Investors’ coupon payments adjust with changes in interest rates; As the floating rate is a combination of the Fed rate or LIBOR, it eliminates the volatility risk for investors; Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

› ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. › terms › cCoupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... EOF

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

en.wikipedia.org › wiki › Interest_rateInterest rate - Wikipedia A discount rate is applied to calculate present value. For an interest-bearing security, coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, whereas current yield is the ratio of the annual coupon divided by its current market price.

All the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. ... Perpetual bonds are types of bonds that pay a coupon rate on the face value till the life of the company. Though Perpetuity ...

Coupon Rate: Formula and Bond Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate of a Bond - WallStreetMojo Coupon Rate is mostly applied to bonds and it is usually the ROI (rate of interest) that is paid on the face value of a bond by the issuers of bond and it is also used to calculate the repayment amount that is made by GIS (guaranteed income security). Table of contents.

What Is the Coupon Rate of a Bond? | SoFi A coupon rate is the nominal interest rate or yield associated with a fixed-income security. A bond coupon rate represents the annual interest rate paid on a bond by the issuer, as determined by the bond's face value. Issuers typically pay bond coupon rates on a semiannual basis. The coupon rate of a bond can tell an investor how much ...

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia Zero-coupon bonds are those that pay no coupons and thus have a coupon rate of 0%. Such bonds make only one payment: the payment of the face value on the maturity date. Normally, to compensate the bondholder for the time value of money, the price of a zero-coupon bond will always be less than its face value on any date

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

› terms › cCoupon Definition - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value, both of...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 95.52: 1.13% +82 +292: 2:06 PM:

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org That said, zero-coupon bonds carry various types of risk. Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

US Treasury Bonds - Fidelity US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly based on discount rates for 13-week treasury bills, principal at maturity: Treasury STRIPS: $1,000: Discount: ... Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. ...

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

![Bond Yield: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/11180917/Bond-Yield-Metrics-e1644621656277.jpg)

![Solved] 2)Colliers Concord Ltd. has recently issued a bond ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/24859591.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 coupon rate on bonds"