44 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ... Finance - Wikipedia Finance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly …

Certificates of deposit (CDs) | Fixed income investment | Fidelity Brokered CD vs. bank CD A brokered CD is similar to a bank CD in many ways. Both pay a set interest rate that is generally higher than a regular savings account. Both are debt obligations of an issuing bank and both repay your principal with interest if they’re held to maturity.More important, both are FDIC-insured up to $250,000 (per account owner, per issuer), a coverage …

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

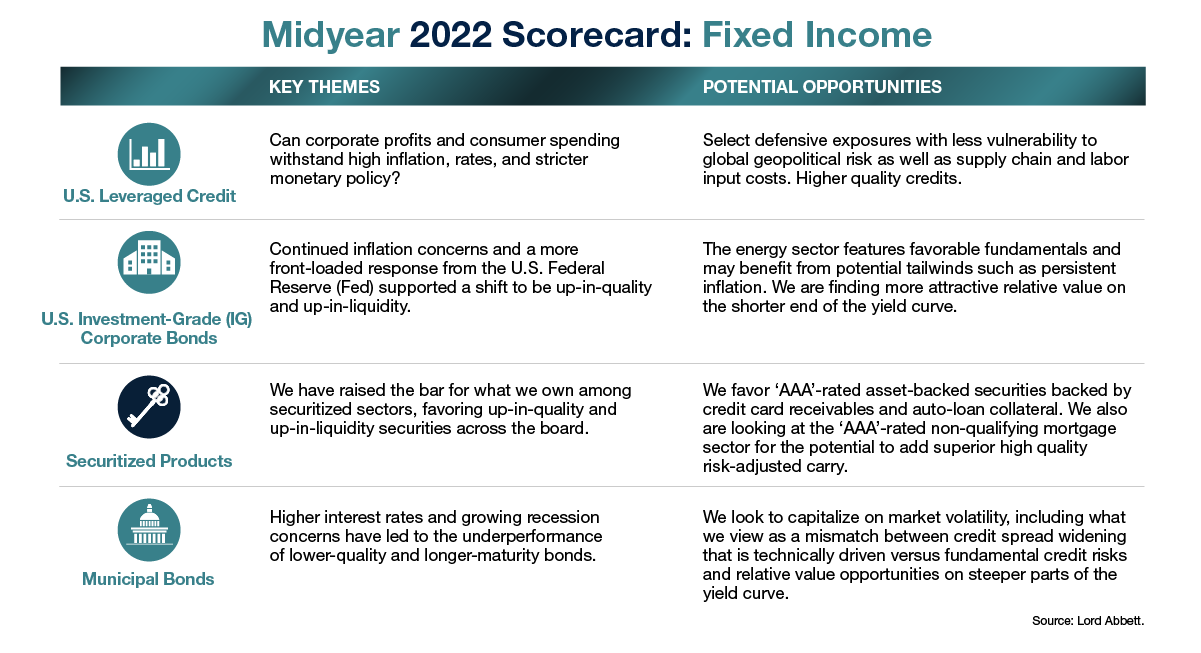

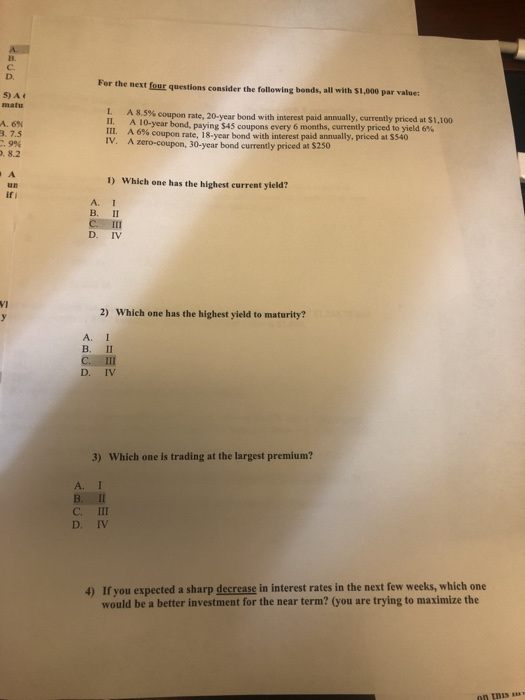

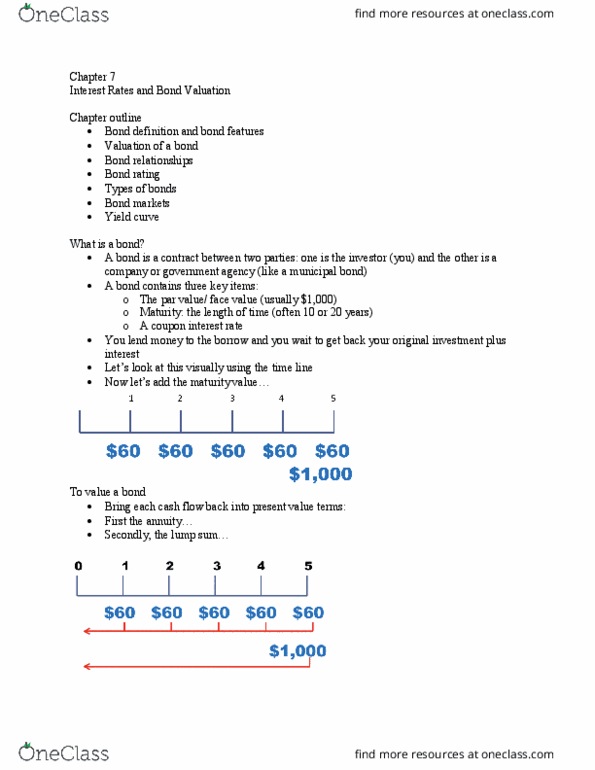

Bond: Financial Meaning With Examples and How They Are Priced 1 juil. 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Fixed Income Glossary - Common Fixed Income Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's secondary market fixed income offerings, … Bond Yield: What It Is, Why It Matters, and How It's Calculated 31 mai 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

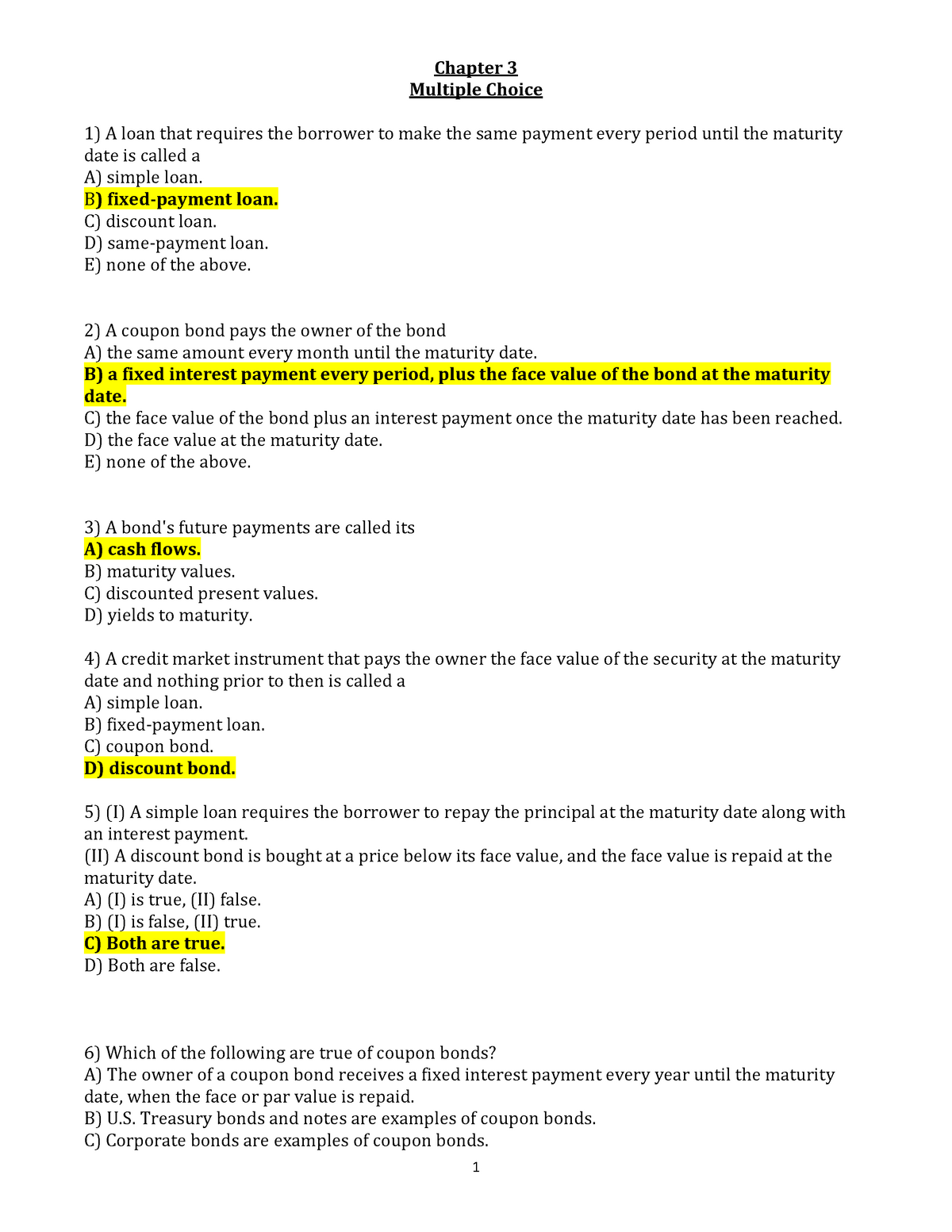

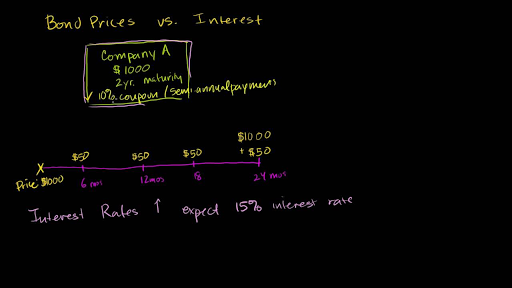

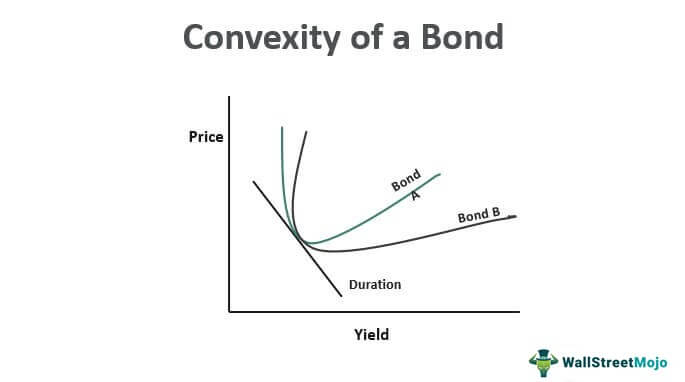

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. Bus1-170 Exam 2 Flashcards | Quizlet Mortgages always have a fixed nominal interest rate. Mortgages always have a fixed nominal interest rate. It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 … Glossary - Common Fidelity Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's secondary market fixed income offerings, … Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Understanding Bond Prices and Yields - Investopedia 28 juin 2007 · As the price of a bond goes up, the yield decreases. As the price of a bond goes down, the yield increases. This is because the coupon rate of the bond remains fixed, so the price in secondary ...

Bond Yield: What It Is, Why It Matters, and How It's Calculated 31 mai 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Fixed Income Glossary - Common Fixed Income Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's secondary market fixed income offerings, … Bond: Financial Meaning With Examples and How They Are Priced 1 juil. 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

.png)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "44 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"