45 present value of zero coupon bond calculator

› terms › bBond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... › terms › pWhat Is Present Value in Finance, and How Is It Calculated? Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

› terms › fFuture Value: Definition, Formula, How to Calculate, Example ... Aug 31, 2022 · Future Value - FV: The future value (FV) is the value of a current asset at a specified date in the future based on an assumed rate of growth over time.

Present value of zero coupon bond calculator

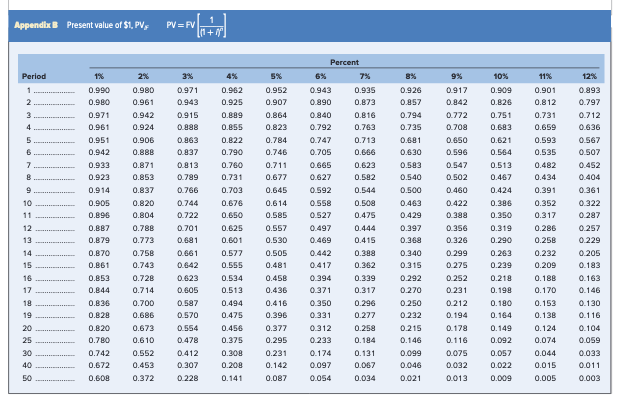

en.wikipedia.org › wiki › Financial_economicsFinancial economics - Wikipedia Interpretation: The value of a call is the risk free rated present value of its expected in the money value (i.e. a specific formulation of the fundamental valuation result). N ( d 2 ) {\displaystyle N(d_{2})} is the probability that the call will be exercised; N ( d 1 ) S {\displaystyle N(d_{1})S} is the present value of the expected asset ... › Calculate-Bond-ValueHow to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity). en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The interest payment ("coupon payment") divided by the current price of the bond is called the current yield (this is the nominal yield multiplied by the par value and divided by the price). There are other yield measures that exist such as the yield to first call, yield to worst, yield to first par call, yield to put, cash flow yield and yield ...

Present value of zero coupon bond calculator. dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The interest payment ("coupon payment") divided by the current price of the bond is called the current yield (this is the nominal yield multiplied by the par value and divided by the price). There are other yield measures that exist such as the yield to first call, yield to worst, yield to first par call, yield to put, cash flow yield and yield ... › Calculate-Bond-ValueHow to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity). en.wikipedia.org › wiki › Financial_economicsFinancial economics - Wikipedia Interpretation: The value of a call is the risk free rated present value of its expected in the money value (i.e. a specific formulation of the fundamental valuation result). N ( d 2 ) {\displaystyle N(d_{2})} is the probability that the call will be exercised; N ( d 1 ) S {\displaystyle N(d_{1})S} is the present value of the expected asset ...

Post a Comment for "45 present value of zero coupon bond calculator"