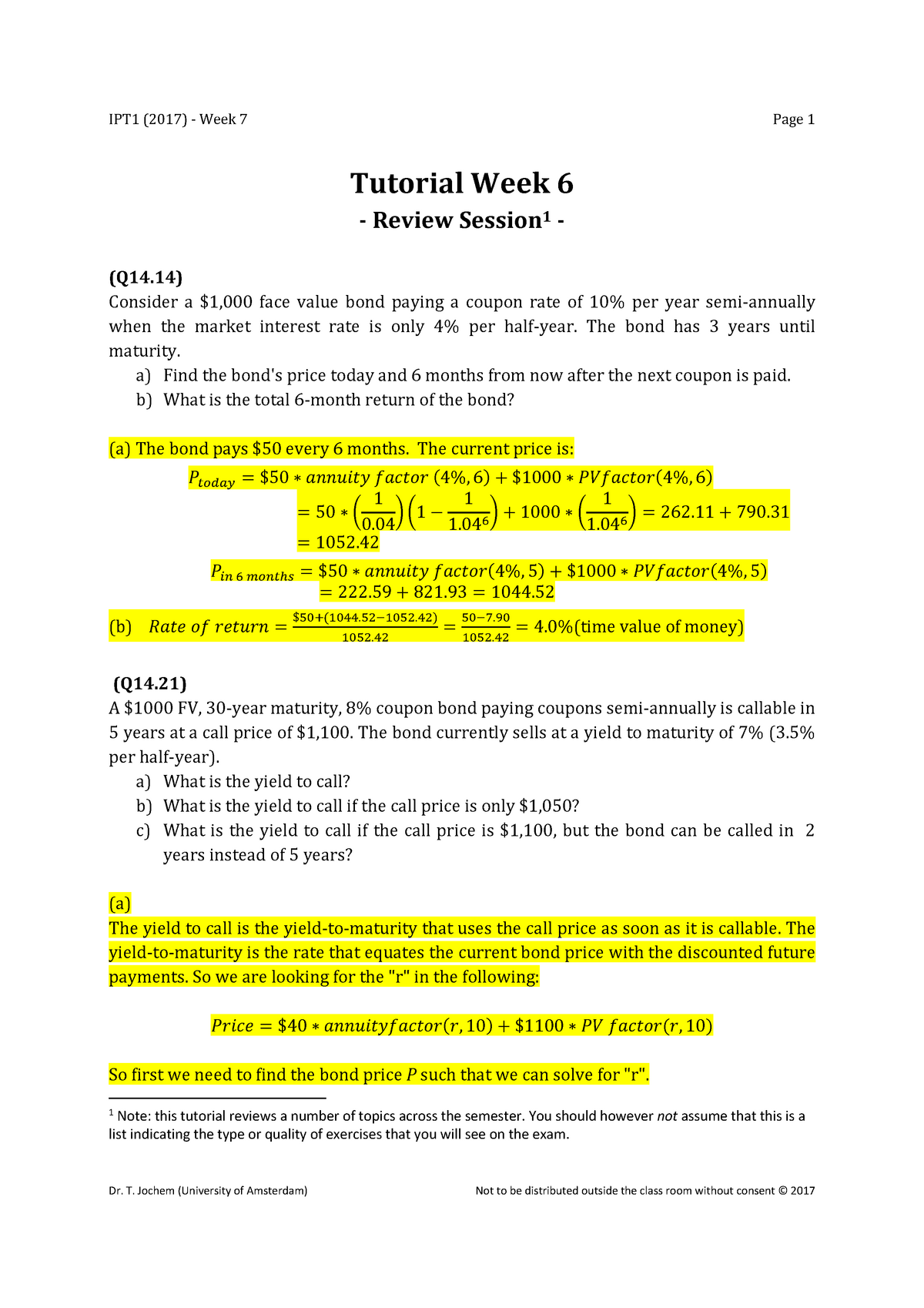

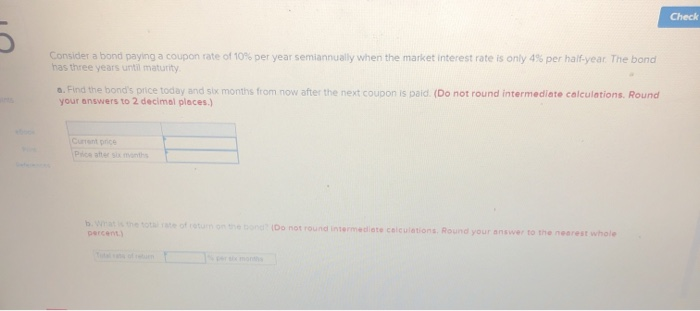

40 consider a bond paying a coupon rate of 10 per year semiannually when the market

Bonds vs. Bond Funds: Which is Right for You? | Charles Schwab Jan 24, 2020 · Since bond mutual funds and ETFs own many securities, the impact of one bond default would likely be less than for an individual investor owning individual bonds. While some bond investments may be made in denominations as low as $1,000 per bond, the appropriate amount to invest is best determined by an individual's investing goals and objectives. Achiever Papers - We help students improve their academic ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

Assignment Essays - Best Custom Writing Services $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ...

Consider a bond paying a coupon rate of 10 per year semiannually when the market

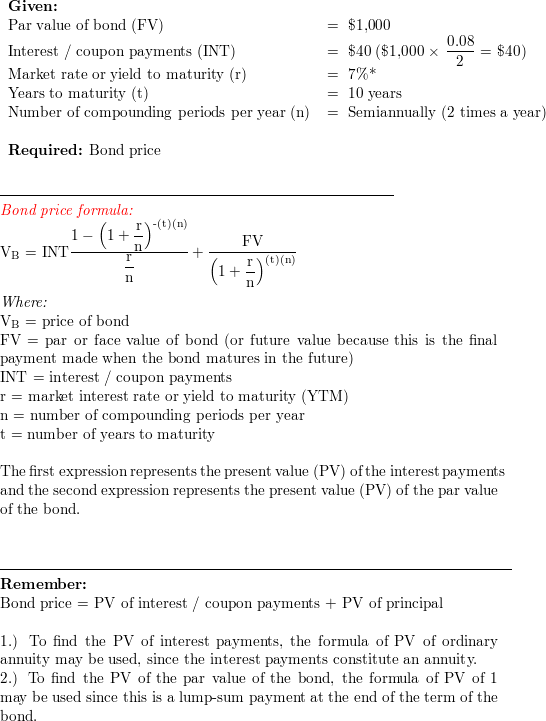

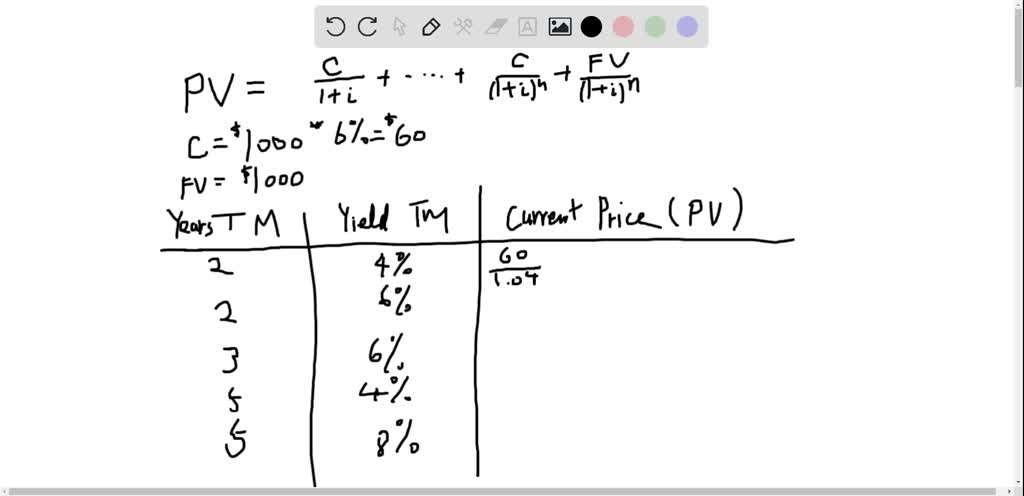

SEC.gov | HOME Nov 16, 2020 · An interest rate swap rate, at any given time, generally indicates the fixed rate of interest (paid semi-annually) that a counterparty in the swaps market would have to pay for a given maturity, in order to receive a floating rate (paid quarterly) equal to 3-month USD LIBOR, or another index rate, for that same maturity. Pro Rata: What It Means and the Formula to Calculate It Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ... How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid.

Consider a bond paying a coupon rate of 10 per year semiannually when the market. How Do Bond ETFs Work? | ETF.com Nov 18, 2022 · A hypothetical $100 bond has a 5 percent coupon — meaning, every year, the bond will pay out $5 to investors until it matures. Then interest rates rise 2 percent. Then interest rates rise 2 percent. How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid. Pro Rata: What It Means and the Formula to Calculate It Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ... SEC.gov | HOME Nov 16, 2020 · An interest rate swap rate, at any given time, generally indicates the fixed rate of interest (paid semi-annually) that a counterparty in the swaps market would have to pay for a given maturity, in order to receive a floating rate (paid quarterly) equal to 3-month USD LIBOR, or another index rate, for that same maturity.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "40 consider a bond paying a coupon rate of 10 per year semiannually when the market"