40 find coupon rate of bond

North County - The San Diego Union-Tribune 16.11.2022 · News from San Diego's North County, covering Oceanside, Escondido, Encinitas, Vista, San Marcos, Solana Beach, Del Mar and Fallbrook. Mashvisor | Short-term Airbnb & traditional rental analysis Our real estate blogs cover all topics related to residential real estate investing such as locating the best places to invest in real estate, conducting investment property search, performing rental property analysis, finding top-performing investment properties, choosing the optimal rental strategy (traditional or Airbnb), and others.

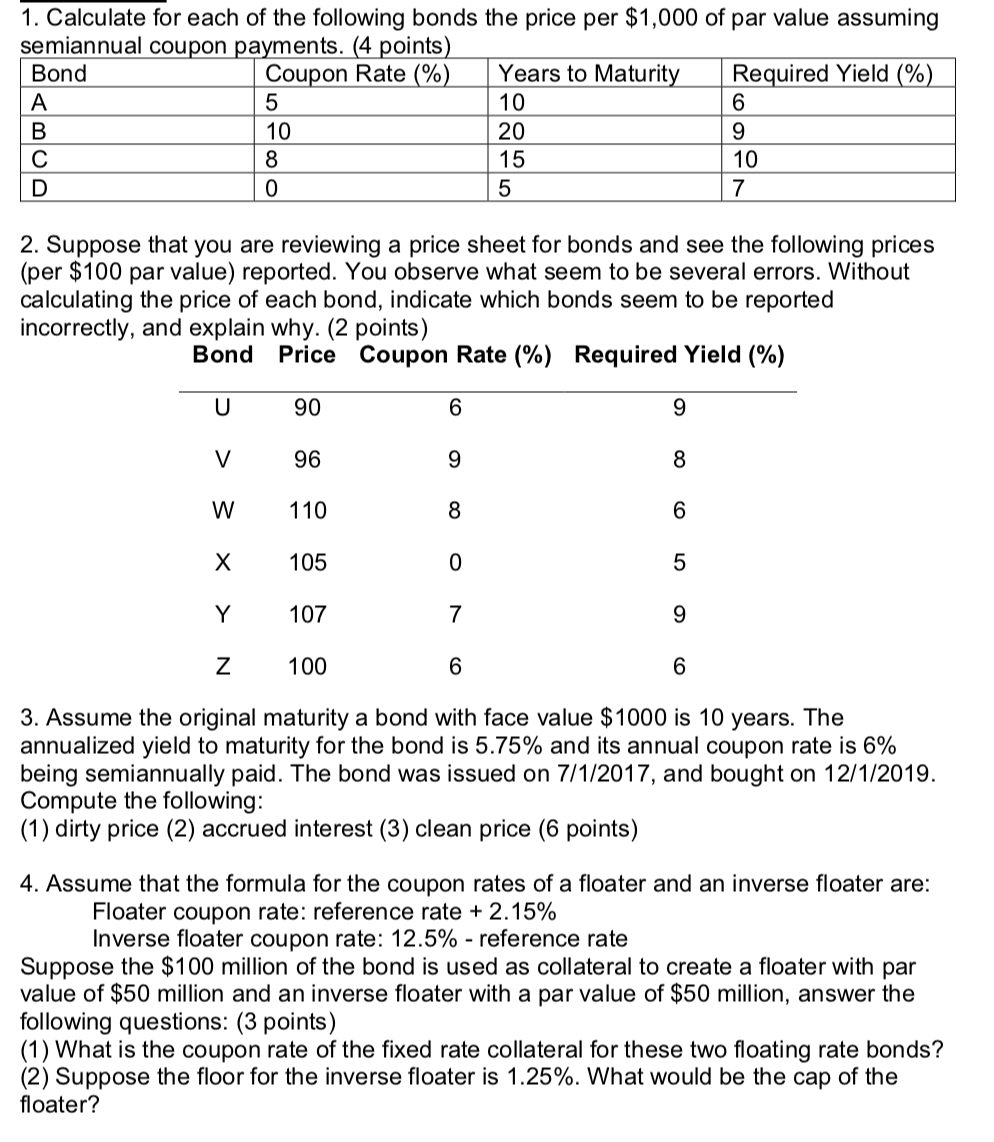

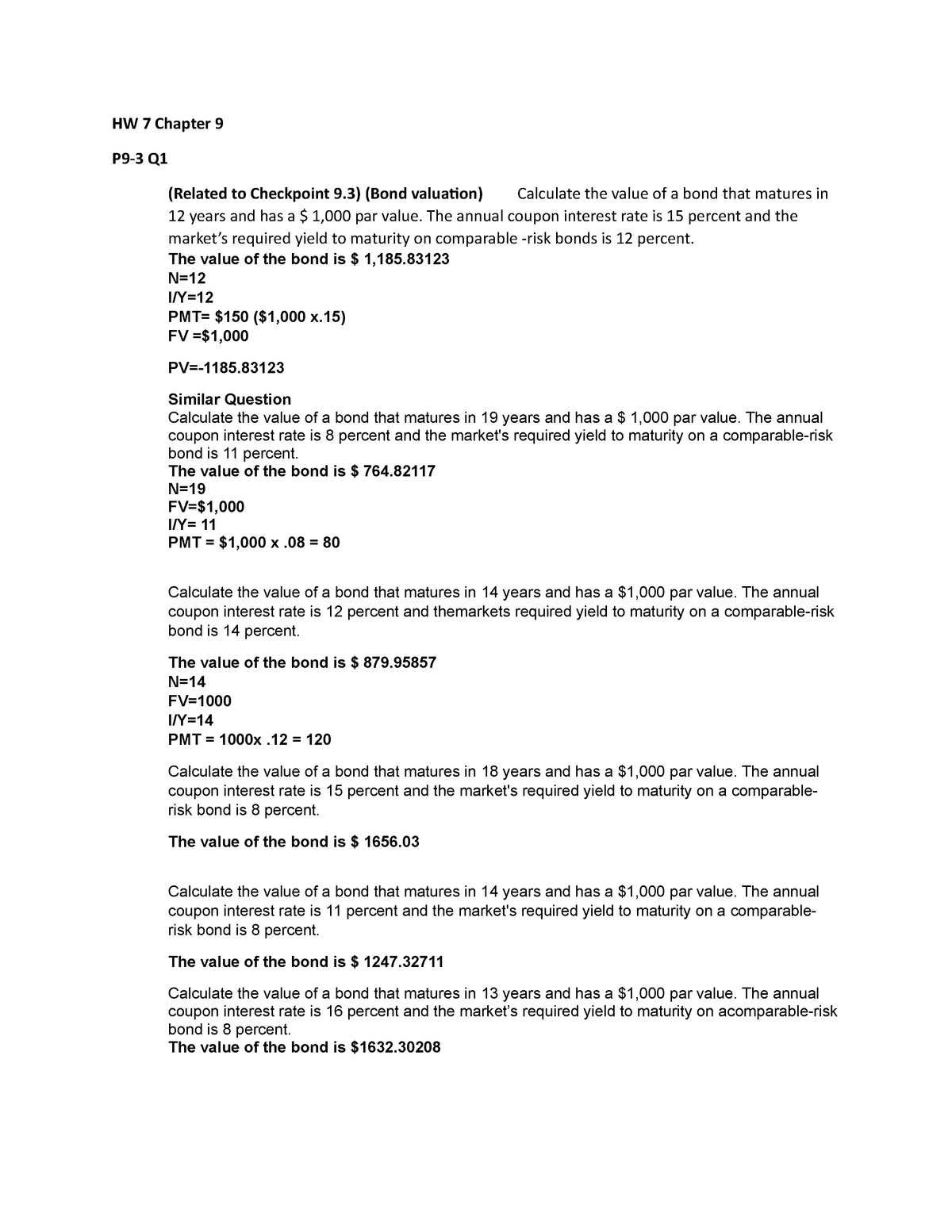

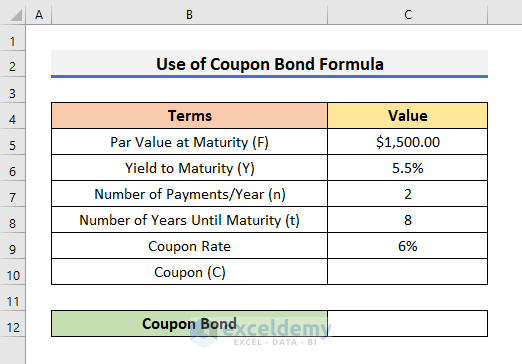

What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

Find coupon rate of bond

Coupon Rate Calculator | Bond Coupon 15.07.2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia 22.03.2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Interest rate - Wikipedia For an interest-bearing security, coupon rate is the ratio of the annual coupon amount ... Yield to maturity is a bond's expected internal rate of return, assuming it will be held to maturity, that is, the discount rate which equates all remaining cash flows to the investor (all remaining coupons and repayment of the par value at maturity) with the current market price. Based on the …

Find coupon rate of bond. GOBankingRates | Personal Finance Site To Help You Find More ... Check Out Our Free Newsletters! Every day, get fresh ideas on how to save and make money and achieve your financial goals. U.S. News | Latest National News, Videos & Photos - ABC News ... Nov 22, 2022 · The suspect is being held without bond on 10 "arrest only" charges. 11/23/2022 06:32:27 EST. Latest U.S. Video. 0:26 'Significant' fine sought for operator of Orlando FreeFall after teen's fatal fall. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are … What Is Coupon Rate and How Do You Calculate It? - SmartAsset How Bond Coupon Rate Is Calculated. The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par value”) of the bond. For example: ABC Corp. releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments …

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Bond Prices, Rates, and Yields - Fidelity Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. That's because each year the bond or CD will pay a higher percentage of its face value as interest. Price—The higher a bond or CD's price, the lower its yield. That's because an investor buying the bond or CD has to pay more for the same return. Mortgage Rates: Compare Today's Rates | Bankrate 20.09.2022 · Compare personalized mortgage rates when purchasing or refinancing your loan. Take advantage of historically low mortgage and refinance rates from our national marketplace of lenders.

Interest rate - Wikipedia For an interest-bearing security, coupon rate is the ratio of the annual coupon amount ... Yield to maturity is a bond's expected internal rate of return, assuming it will be held to maturity, that is, the discount rate which equates all remaining cash flows to the investor (all remaining coupons and repayment of the par value at maturity) with the current market price. Based on the … Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia 22.03.2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Coupon Rate Calculator | Bond Coupon 15.07.2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

![Solved Problem 6-33 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/f0d/f0d3e3cc-89c9-4eed-b5c1-9f247c01695c/php2LGFUe.png)

Post a Comment for "40 find coupon rate of bond"